Blog

2025-11-19

Technology

Introducing $IRYS Tokenomics

Introducing $IRYS:

TL;DR

- Native asset: $IRYS powers the Irys Data Layer and the IrysVM execution layer.

- Utility: Pay for data storage (temporary or permanent) and execution on IrysVM.

- Fee model: All fees paid in $IRYS, pegged to USD bands reviewed annually for predictable costs. Minimum fee = $0.001.

- Consensus: Hybrid Useful Proof of Work and Stake (uPoW/S), requiring miners to stake $IRYS and continuously prove maintenance of assigned data partitions.

- Issuance: 2% annual rewards to validators/miners, halving every four years.

- Deflationary design: 50% of execution fees and 95% of term-storage fees are burned; permanent-storage fees flow to the non-circulating Irys Storage Endowment.

- Supply cap: 10 billion $IRYS.

- Launch state: 20% of supply circulating; team and investors locked for year one.

Token Utility and Flows

$IRYS circulates through three primary systems: usage, security, and sinks, each reinforcing the others.

1. Usage: paying for computation and storage

Every network action consumes $IRYS:

- Execution: Smart-contract calls on IrysVM pay compute fees.

- Term storage: Temporary data uploads pay duration-based fees pegged to USD.

- Permanent storage: One-time payments fund perpetual retention through the Storage Endowment.

Fees for all network actions are denominated in $IRYS. Irys uses a USD-based pricing model for both temporary and permanent storage that is recalibrated annually to the physical costs of storage. This design provides stable and predictable economics for users and developers.

A $0.001 minimum fee applies to each transaction to deter spam and ensure consistent economics.

2. Security: staking, validation, and rewards

Validators stake $IRYS to participate in consensus and verify data integrity.

- Honest validators earn block rewards (2% annual issuance, halving every four years) plus a share of network fees.

- Misbehavior or data loss triggers slashing of the validator's stake.

- Token holders will be able to delegate their stake to validators and share rewards proportionally once delegation is live. Launch timing will be announced on official Irys channels.

This connects network integrity directly to token value as higher usage increases fee volume, which strengthens staking yield and driving demand for $IRYS.

3. Sinks: burns and the Storage Endowment

Each transaction also removes tokens from circulation:

- 50% of execution fees burned.

- Over 95% of storage fees burned.

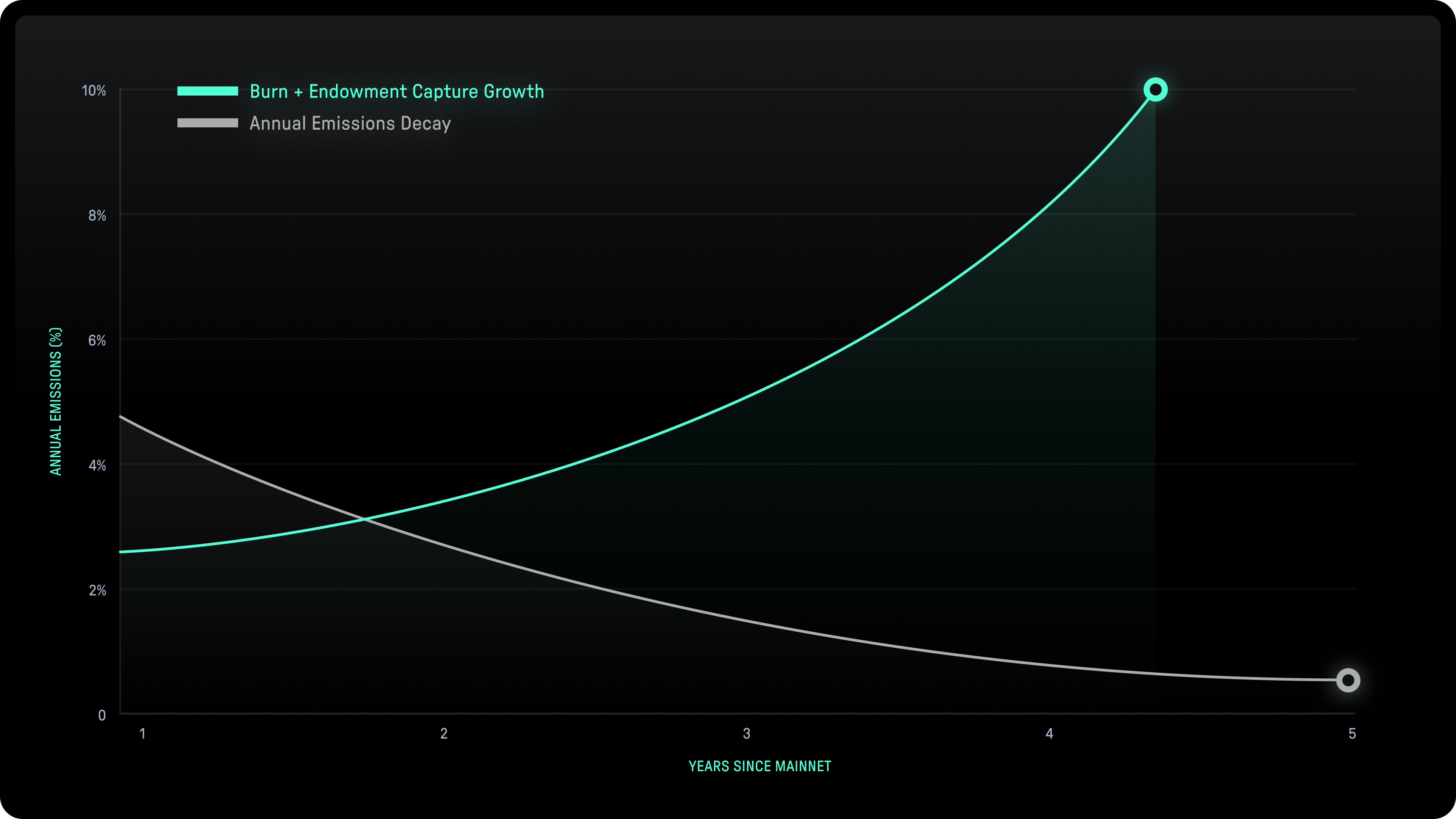

As network activity grows, these sinks counterbalance issuance, driving $IRYS toward net deflation. This results in a self-correcting economy where growth drives utility and security while tightening supply.

Token circulation and burn mechanics

Long-Term Alignment

Incentives

The token model evolves as the network grows:

Early on, issuance funds security while the Ecosystem and Foundation pools bootstrap builders, infrastructure, and partnerships.

As network usage accelerates, fee sinks and the Storage Endowment become the dominant economic drivers, gradually tightening supply and reducing reliance on emissions.

This hand-off ensures that Irys remains self-sustaining even as emissions decline.

As more data and applications flow through Irys, activity fuels burns, burns tighten supply, and a scarcer token strengthens security incentives.

Supply, Allocations & Vesting

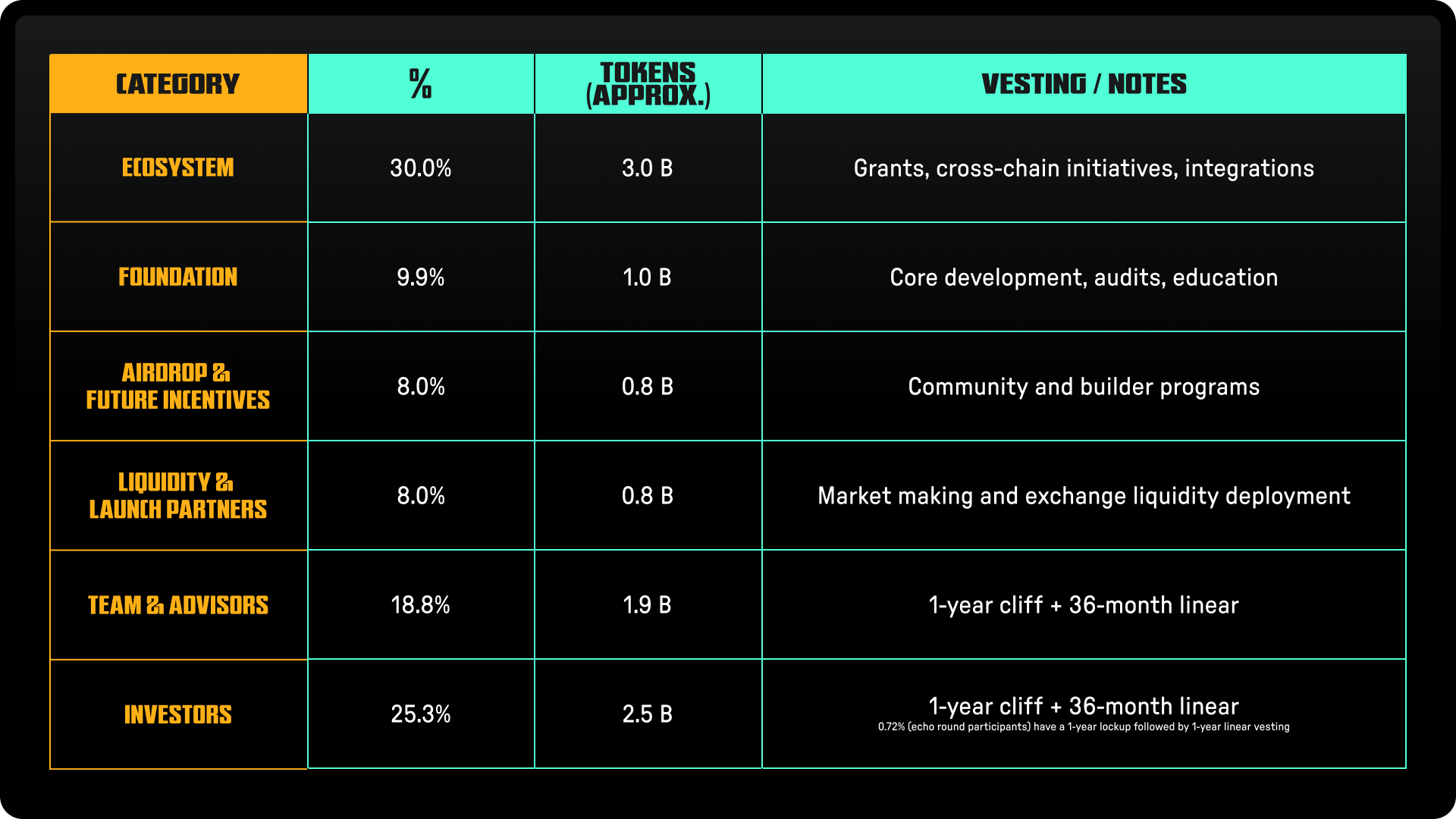

The initial $IRYS supply is 10 billion tokens, distributed to align long-term incentives between builders, validators, and the community.

Initial token distribution and allocations

At launch[1], approximately 20% of supply will circulate through community, ecosystem, and liquidity allocations.

Team and investor tokens remain locked for the first year.

Closing

Irys tokenomics were built from first principles to create a system grounded in clear economics, designed to endure, and aligned with the people who use it.

Every action on Irys feeds the same loop:

Use the network, secure the network, make the network stronger.

[1] Liquidity, Ecosystem, and Foundation context

- Initial allocations sustain network stability and long-term growth

- Liquidity and Launch tokens are used with exchange and market-making partners to seed both centralized and decentralized venues, keeping spreads tight and access consistent.

- Ecosystem tokens fund structured programs (e.g., developer grants, integrations, adoption incentives) to expand network usage.

- Foundation Tokens support ecosystem growth and maintain network reliability (e.g., funding protocol development, security audits, infrastructure operations, cross-ecosystem initiatives).